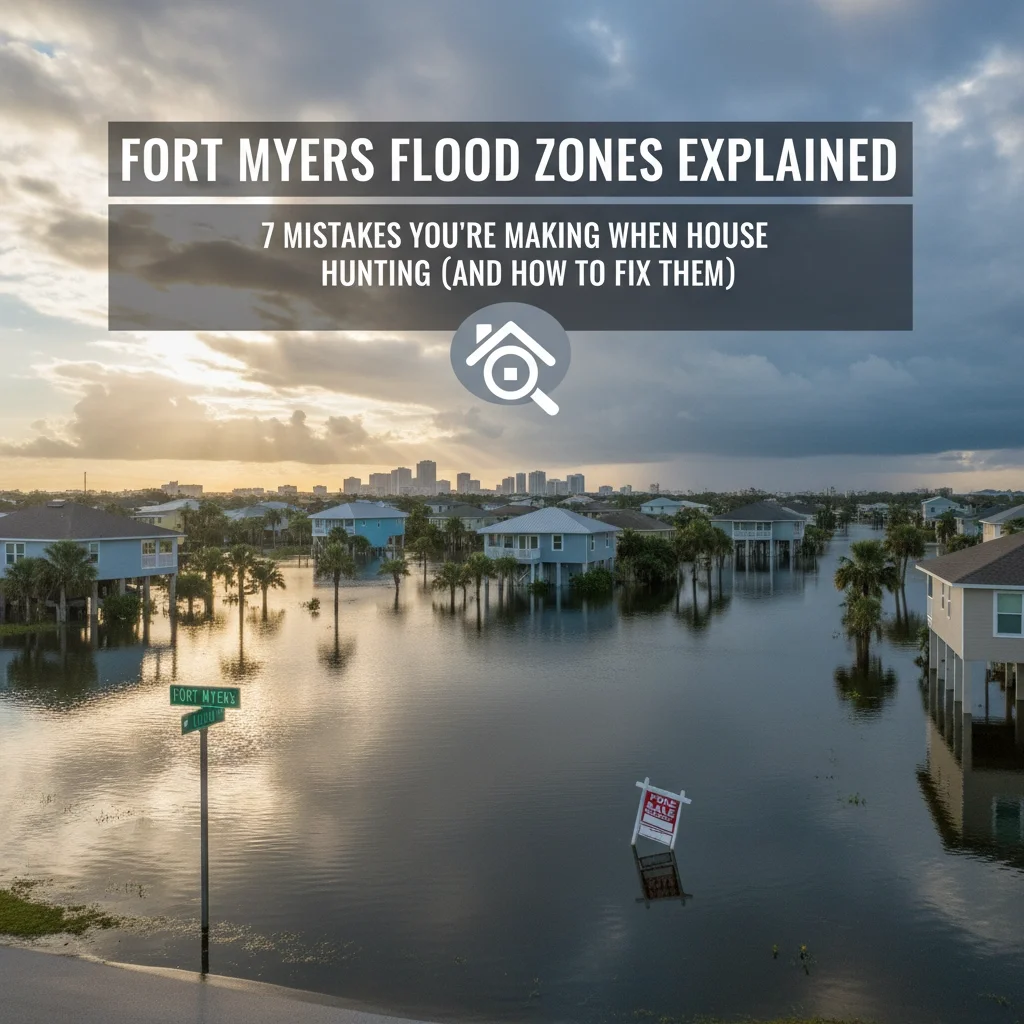

Fort Myers Flood Zones Explained: 7 Mistakes You're Making When House Hunting (and How to Fix Them)

If you're house hunting in Fort Myers, understanding flood zones isn't just helpful: it's absolutely essential. With Southwest Florida's unique geography and weather patterns, flood risk can make or break your homebuying decision. Yet every week, I see buyers make costly mistakes that could've been easily avoided with the right knowledge.

The truth is, Fort Myers flood zones got a major update in November 2022, and many buyers (and even some agents) are still catching up. These new FEMA flood maps are more precise than ever, but they've also created some confusion about what different zones actually mean for your wallet and your future.

Let me break down everything you need to know, starting with the mistakes that could cost you thousands.

Understanding Fort Myers Flood Zones: The Basics

Before we dive into the mistakes, here's what you need to know about Fort Myers' current flood zone system:

Zone VE (High Risk - Coastal): The most restrictive designation. Your home must be elevated on piles with no ground-level enclosures. Flood insurance is mandatory and expensive.

Coastal A Zone (High Risk - Coastal): This is new as of 2022. Similar building requirements to VE zones, with mandatory flood insurance and strict elevation requirements.

Zone AE (High Risk): Properties must be elevated on fill or foundation walls with proper flood openings. Flood insurance is mandatory.

Zone X (Shaded/Unshaded): Moderate to low risk. Shaded X has moderate risk, unshaded X has the lowest risk. Flood insurance is optional but recommended for shaded zones.

Now, let's talk about where buyers go wrong.

Mistake #1: Not Checking the Official FEMA Flood Map First

Here's what happens: You fall in love with a house, make an offer, then discover it's in a high-risk flood zone during the inspection period. Suddenly, your dream home comes with a $3,000+ annual flood insurance bill you never budgeted for.

How to Fix It: Before you even schedule a showing, check the property's flood zone designation. Use FEMA's Flood Map Service Center online or Lee County's GIS tool "Find My Flood Zone." It takes literally five minutes and could save you from heartbreak (and financial shock) later.

Your agent should be doing this automatically, but double-check yourself. Properties in red on the maps are VE zones, blue indicates AE zones. Know this before you fall in love with the house.

Mistake #2: Thinking Your Homeowners Insurance Covers Floods

This might be the most expensive misunderstanding in Florida real estate. I've seen buyers discover this gap in coverage after closing, sometimes during their first storm season.

How to Fix It: Understand that homeowners insurance covers water damage from things like burst pipes or leaking appliances: not weather-related flooding. You need separate flood insurance through the National Flood Insurance Program (NFIP) or private insurers.

If your property is in a high-risk zone (VE, Coastal A, or AE), flood insurance is mandatory for your mortgage. Budget for this cost upfront: it can range from a few hundred to several thousand dollars annually depending on your zone and elevation.

Mistake #3: Ignoring the Property's Flood History

Past performance predicts future results, especially with flooding. If a house has flooded before, it's likely to flood again. Yet many buyers skip this crucial research entirely.

How to Fix It: Ask the seller directly: "Has this home ever flooded, and if so, how often?" Don't stop there. Research local flood history through news articles, community reports, and county records.

Look for signs of previous water damage during your inspection: things like water stains on walls, warped flooring, or fresh paint in basements that might be covering flood damage. A property's flood history should factor heavily into your decision and negotiation strategy.

Mistake #4: Not Understanding Your Specific Zone's Requirements

Different flood zones have completely different rules for building, renovating, and insuring your property. Not understanding these requirements can lead to expensive surprises when you want to make improvements or need to rebuild after damage.

How to Fix It: Learn what your zone designation means for building codes and future construction. For example:

VE zones require elevated construction on piles with no ground-level enclosures

Coastal A zones (new in 2022) have similar requirements to VE zones

If your property straddles two zones, the more restrictive one applies

Understanding your zone helps you budget for future improvements and renovations. Some zones require special permits and engineering that can add significant costs to even simple projects.

Mistake #5: Overlooking Existing Flood Mitigation Features

Some homes already have protective features like sump pumps, elevated electrical systems, or improved drainage. These features can reduce both your risk and your insurance costs, but only if you know about them and maintain them properly.

How to Fix It: During your home inspection, specifically ask about flood mitigation measures. Look for:

Sump pumps and backup power systems

Elevated utilities (electrical panels, HVAC systems, water heaters)

Proper grading that slopes water away from the foundation

French drains or other drainage improvements

Flood vents in foundation walls

Document these features: they can help with insurance discounts and provide peace of mind. Make sure you understand how to maintain them properly.

Mistake #6: Not Getting an Elevation Certificate

An elevation certificate documents your home's height relative to the Base Flood Elevation (BFE), basically, how high your home sits compared to the minimum required elevation. This document is crucial for accurate flood insurance pricing and proves your home meets current regulations.

How to Fix It: Ask if the home already has an elevation certificate and request a copy during the sale process. If one doesn't exist, you'll need to hire a licensed surveyor to create one (expect to pay $500-$1,500).

This certificate becomes especially important if:

Your home is built above the required elevation (you'll pay lower insurance premiums)

You plan to renovate (you'll need it for permits)

You want to sell later (buyers will want to see it)

Mistake #7: Being Blindsided by Insurance Costs

Flood insurance premiums in Fort Myers can vary dramatically based on your zone, elevation, and the age of your home. Many buyers don't research these costs until after they've committed to purchase, leading to budget stress or deal cancellation.

How to Fix It: Get flood insurance quotes early in your house-hunting process. Ask your insurance agent to run quotes for properties you're considering. Key questions to ask:

What's the annual premium for this specific property?

Is the current flood policy transferable to new owners?

Are there any discounts available for elevation or mitigation features?

How might premiums change over time?

Remember that homes in high-risk zones face not just mandatory insurance requirements, but also potentially slower appreciation and higher overall ownership costs. Factor this into your long-term financial planning.

Your Next Steps

Understanding Fort Myers flood zones doesn't have to be overwhelming. The key is doing your homework before you fall in love with a property. Use official resources like FEMA's Flood Map Service Center and Lee County's GIS mapping system to verify flood zones and access detailed information.

When you work with an experienced local agent who understands Southwest Florida's unique flood risk landscape, you're setting yourself up for success. At AnchorPoint Real Estate, we make sure our clients understand every aspect of their potential investment, including flood zone implications, before they make an offer.

Ready to start your Fort Myers house hunt with confidence? The market is full of great opportunities: you just need to know what questions to ask and what red flags to watch for. With the right preparation and professional guidance, you can find a property that fits both your lifestyle and your risk tolerance.

Don't let flood zone confusion derail your homebuying dreams. Get educated, ask the right questions, and make informed decisions. Your future self will thank you.